Wireless Spectrum isn’t for Cellular Operators Anymore Just

Cable operators scored a large win within the race for 5G by diving in to the Government Communications Commission’s (FCC) latest Citizens Broadband Radio Service (CBRS) spectrum auction. Three of the country’s largest cable connection businesses – Cox, Comcast, and Charter – collectively bid a lot more than $1 billion to gobble upward mid-band spectrum perfectly fitted to 5G. This claims to become a game-changer in cellular offerings.

These three big Multisystem Operators (MSOs) bought a collective 19-24MHz for $1.14 billion across their wireline footprints, combining for 4.6BMHz Point of Existence (POPs), or .25 cents per MHz/POP. It is a regular measurement for the worthiness of spectrum predicated on how many folks are covered versus just how much spectrum is available.

The CBRS licenses are for 10-year periods and purchased on a per-county basis, with 40MHz obtainable in any given county, plus some of the may cover large, cities. Cable companies can deliver consumer mobile solutions now, Fixed Wireless Accessibility (FWA) providers, and Managed Private Systems (MPNs) for enterprises. In the first phase, MPNs (4G/5G+WiFi6) will undoubtedly be very appealing to enterprises because they don’t need to purchase or sublease the permit for your county and can depend on the knowledge from MSOs to perform these networks.

As the ongoing services work each outdoors and indoors, enterprises may decide to use it for connecting their Internet of Things (IoT) devices. They could even use it to displace or supplement Wi-Fi along with IoT connectivity. Service providers, in the meantime, will likely use CBRS to provide FWA services so when an upgraded for last-mile fiber accessibility and consumer mobile assistance to offload their visitors from their Cell phone Virtual System Operator (MVNO) partner.

Area of the lure inside the buying spectrum for these MSOs would be to build their very own inside-out wireless systems to get rid of high roaming expenses they’re paying major cell phone providers through MVNO agreements. Analysts estimate they’re paying around $700 million in MVNO costs each year.

How cable operators can easily win with CBRS

The cellular “greenfield” cable companies don’t have legacy 3G or 4G networks to create from, however, they’ll have to make some big choices around the architecture. Should they focus on 4G and migrate to 5G or go right to 5G then? Should they consider the standard radio design or the brand new disruptive open up Radio Access System (oRAN) architecture? Heading all cloud-native is really a zero brainer but how distributed the system ought to be is a choice they have to make. Choosing what degree of automation and safety will enable them to perform this network at a stylish cost should be an integral driver.

In the 4G planet, Cisco is really a leading company of packet core and we’re radio agnostic. During the past, service providers had been locked into whoever possessed the air, but we are able to give operators a whole lot of flexibility. Not being locked right into a vendor is really a huge advantage from the cost perspective since they can buy radio equipment from smaller sized, less expensive, and much more agile vendors which will be more available to meeting their needs than larger businesses. Another advantage has been in a position to mix and complement from several different suppliers and operate them across different parts of their market to recognize which ones will be the best performers.

As a head in 5G, we’re a founding person in the Open RAN Plan Coalition. Our initial oRAN deployment was an extremely successful Non-Standalone (NSA) system with Rakuten in Japan. The very best section of that deployment is that Rakuten is absolve to partner with any true amount of vendors. DISH Network in addition has publicly stated its purpose to create a 5G Standalone (SA) network using oRAN technologies, so it’s obviously gaining traction through the entire industry.

Cable operators have to consider new technology because they expand and modernize systems to fully capture new service possibilities. Not really being locked down between compute and radio allows them to increase their expense in compute. Also, that they’ve jumped in to the mobile company with both feet right now, cable executives will be under increasing pressure to create these new ventures rewarding. For example, Comcast’s supplying is reportedly on the right track to break by the finish of 2021 with approximately 3 even.5 million outlines of service. Making use of oRAN could really help to make this possible while conserving Capital Expenditures (CapEx) and maintaining those costs off the books.

How shall this affect 5G development?

CBRS spectrum is likely to cover 80 % of cable clients in the usa. That’s a very huge swath of the united states and could mean a lot of money for the MSOs should they use it ideal. That’s why the FCC is usually referring to this because the “5G spectrum”. This can make the big wire companies very aggressive in the competition to roll out SA 5G networks.

Because they are not used to this domain, their competitiveness shall result from having the ability to offer more customized solutions because of their customers. As Wire Operators modernize and include new capabilities with their network, they have to look to the near future – go correct for 5G. The 4G subscribers today will encounter a routine of upgrades on the next 24-36 months when nearly all will transfer to the 5G telephone domain, and all smartphones will be 5G next few years.

Did you know Cisco is really a leading security supplier, protecting completely of the Fortune 100? Or our automation tools give a bridge between activity and intent? No one is way better equipped to protected the cable system. We’re getting into a domain where 5G networks are complicated, with automation and security getting core fundamentals of the solutions. Cisco isn’t a mobile player simply, we’re an end-to-end system provider with SD-WAN and security portfolios, and dashboards for full system control and visibility.

The future of wireless is multi-access

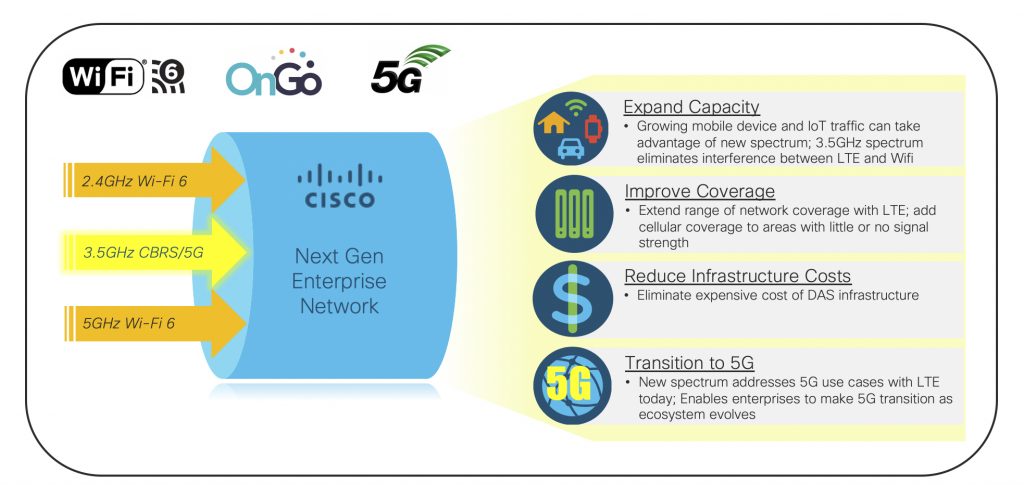

That cable businesses have purchased the spectrum permit now, they can present 5G to enterprises simply because a managed program and few it with Wi-Fi 6 to cover up a large selection of use situations. By teaming up with providers, they could be brought by us a best-of-breed ecosystem. In this way, wire operators can pinpoint regions of priority that could have an increased take price for the service therefore they’re not really stuck and will adjust as needed.

We’re building away this ongoing service thus we are able to learn together, iterate on improvements, and identify high-priority locations. As an associate of the CBRS Alliance, we anticipate dealing with these MSOs because they build away their new systems. At SCTE-ISBE Wire Tec Virtual Expo, we are speaking on The state of Converging Access & 5G Mobile Networks. Start your digital experience around now. Visit Cisco’s Cable Tec Expo reward microsite and catch through to how cable operators will get ahead of unpredictable requirement with a following generation modern wire network.

The post Wireless Spectrum isn’t just for Mobile Operators Anymore appeared 1st on Cisco Blogs.